Sweden has one of the most comprehensive regulatory systems when it comes to iGaming, but if an operator selects the right supplier partner that utilizes technology to enrich the player betting experiences even with the regulatory limitations, it is absolutely worth it.

As a large and dynamic market with high-valued players, it is attractive in the region, but not everyone can succeed there. Why they should try, however, is evident from the paragraphs below, where we have an in-depth look at the current situation, the regulatory framework, advertising rules, and more about the Swedish iGaming Market.

Contents

Current iGaming Market in Sweden

Online Gambling Legislation in Sweden

Advertising Rules for Gambling in Sweden

Preferences of Swedish Online Gamblers

Popular Games and Sports to Bet on in Sweden

Ways To Operate Successfully in Sweden Even with the Regulatory Limitations

The Future of Gambling in Sweden

In Conclusion

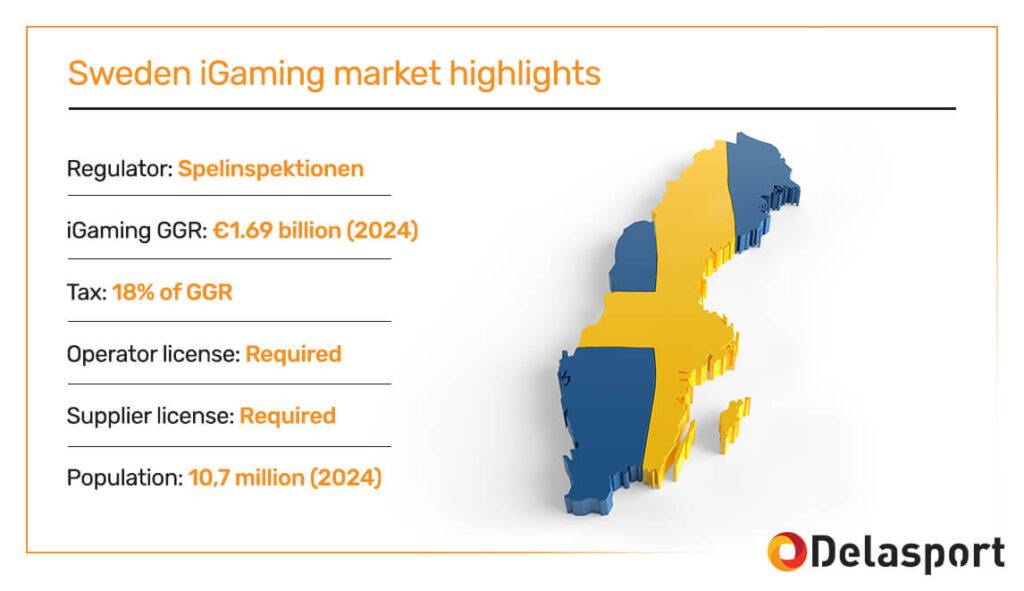

The Swedish iGaming market is growing fast: In 2017 it had €0.52 billion in GGR while the projections for 2024 are for it to reach €1.69 billion (Source). By the end of 2028 forecasts predict a peak of €2.15 billion.

Same goes for the number of players – it has been on the rise for as long as tracking has been conducted. In 2022, for example, the number of gamblers in Sweden saw a significant increase, rising to 72%, compared to the 58% recorded in 2018 (Source).

In terms of taxation, an 18% tax rate applies to gross gaming revenues across all forms of gambling. As a result, the State's gambling revenue reached €720 million in 2021, encompassing contributions from gambling tax, corporation tax, and dividends from Svenska Spel AB - the state-owned company in Sweden that operates in the market. It is responsible for offering various forms of gambling services, including lotteries, sports betting, and casino games.

Sweden is among the more strictly regulated iGaming markets. The Spelinspektionen, also known as the Swedish Gambling Authority (SGA), has been overseeing the regulation of all gambling activities in the Nordic country since January 2019. The authority is committed to implementing robust measures aimed at sustaining a balanced, fair and transparent gaming market. It places special emphasis on mitigating potential adverse social effects of gambling, such as underaged players and problem gambling.

The Spelinspektionen monitors three distinct categories: online gaming and betting, the state monopoly encompassing live casinos and cash machines, and lottery and bingo. In terms of market share, online casinos held the largest portion, followed by sports betting (including horse betting) and lotteries.

These legislative changes follow the introduction of supplier licenses on July 1 and new enforcement powers for Spelinspektionen. The government has also proposed increasing the gambling tax rate from 18% to 22% of gross gaming revenue in July 2024. Proponents of this proposal argue that the gambling market has been stabilized since the regulation initiative started in 2019. Thus, even with the increased GGR tax, a 90% channelization can be maintained.

To the contrary, the Online Gaming Industry Association (BOS) argues that in line with the results of a specialized survey carried out in Q1 2023 the actual levels of channelization amount to 77% (Swedish gambling industry as a whole), 72% (Swedish iGaming sector), and 84% for betting on sports in particular. An increased GGR tax in combination with stringent legal obligations, which lead to an unwelcoming customer experience, grants the unlicensed operators a competitive edge.

In line with the tax increase proposal and the 90% channelization goal, the Swedish Gambling Authority will deploy a new strategy for tackling illegal gambling operations. It consists of investigating whether online games are targeting Swedish customers, by taking into account among others:

In Sweden, all forms of gambling and betting are permitted, along with their advertising, but as everything else - there are strict regulations in place outlined in the Swedish Gambling Act. According to marketing regulations, only games and lotteries licensed in Sweden can be advertised. Betting promotions are supervised by Hallå konsumer, a nationwide information service coordinated by the Swedish Consumer Agency. The primary guideline for gambling advertising is "moderation." Notably, promotions cannot target individuals under 18 or those who have voluntarily excluded themselves from gambling activities or have been identified as problem gamblers.

Prior to advertising a gambling site in Sweden, adherence to government requirements is essential. For sports betting or casino sites with a Swedish license, specific criteria must be met, including:

When bonus advertising is concerned, a license holder may only offer or provide bonus offers the first time a player participates (welcome bonus) in one of the license holder’s games. Given that a bonus is defined as “a discount or similar financial incentive that is directly linked to the gambling”, the possibilities of promotional activities or rebates are very limited. The Swedish Gambling Authority has issued large fines against operators who have violated the bonus provision. (most notably against LeoVegas and ATG in 2021).

Compliance with self-exclusion services, such as Spelpaus.se, and displaying the regulator Spelinspektionen's logo is mandatory.

As of 2022, there has been a 15% decrease in gambling advertising expenditure in traditional media compared to 2021. Notably, €3.4 billion was allocated in 2022, down from €4 billion.

Online casino advertising (30%) and sports betting (28%) remain prominent. In September 2022, a notable change occurred as the Swedish gambling regulator prohibited the autoplay mode in online slots, aligning with practices in the UK and the Canadian province of Ontario.

Recently, The Culture Committee of Sweden’s Riksdag has rejected a proposal to enforce stricter advertising regulation for higher risk gambling products, arguing that it was an attempt to bring in a tiered system “by the back door” (Source).

The committee's stance was presented in its report on a gambling reform bill designed to minimize harm and enhance channelization.

Originally, the government had contemplated prohibiting "high-risk" gambling advertisements from 6 am to 9 pm.

Yet, in the official version of the law released by the government, it decided against enforcing a ban. Instead, it specified that gambling advertisements should be subject to "modified moderation."

The habits of Swedish online bettors were summarized by a report last year (July 2023), based on a survey by Swedish Gambling Authority (Spelinspektionen). The results are rather intriguing:

The robust economy and elevated disposable income levels in Sweden have also contributed significantly to the expansion of the online gambling market. Increased disposable income prompts individuals to participate in leisure activities, including iGaming. Furthermore, the cultural acceptance of gambling in Sweden as a form of entertainment further propels market growth.

Take a look at our other iGaming market reports

The same survey, but in 2018, revealed more relevant information regarding the preferences of Swedish bettors. Their favorites among casino games and sports are rather clear:

In recent years, eSports are also on the rise in Sweden. According to the Computer Sports Federation, the Swedes lead the industry on a par with China, the USA, Germany, and the UK. These indicators make this niche a must-have for a sportsbook In the Nordic country.

With the harsh regulatory requirements that allow only a Welcome bonus and the fact that mostly all licensed operators in the market have the same content or access to the same content, to succeed in Sweden an operator must have a strong platform, casino, and sportsbook supplier. Such a supplier should offer unique features that elevate the betting experience and help acquire and retain players. At Delasport we are focusing on harnessing the insights gained from betting activities to produces dozens of features:

These are just a few examples of the variety of functionalities Delasport keeps developing and introducing to help operators stand out in their markets.

Licensed Operators will be able to take a bigger market share if they present the right products and services to players. The bonusing limitation presents a real challenge that all licensed operators are facing. However, the greater the challenge, the larger the potential for the operator to stand out. If the operator makes it a point to differentiate through a higher overall betting experience, success is guaranteed. It is not clear what the iGaming future holds as changes keep coming, e.g. the recent license regime of last July (2023). What is known is that the Swedish market is still growing GGY-wise as more players are joining, so it should be a target market for any serious operator.

As Sweden navigates the intricate landscape of its gambling industry, regulatory decisions play a pivotal role in shaping its future. The rejection of stricter advertising rules, proposed amendments to the Gambling Act, and ongoing discussions about tax increases underscore the delicate balance between fostering a competitive market and ensuring consumer protection.

In case you’re looking for a trusted and experienced partner to enter this exciting market with, definitely reach out to us at Delasport. We offer a modern Sportsbook solution in Sweden and as an operator there, you will have access to a Sportsbook that maintains two two-digit margins through the best traders and risk managers in the industry, player Personalization, unique ways to bet, real-time player engagement tools, and more.

If this sounds thrilling, book a meeting right away: https://calendly.com/rosaire-cavallaro/delasport-sportsbook