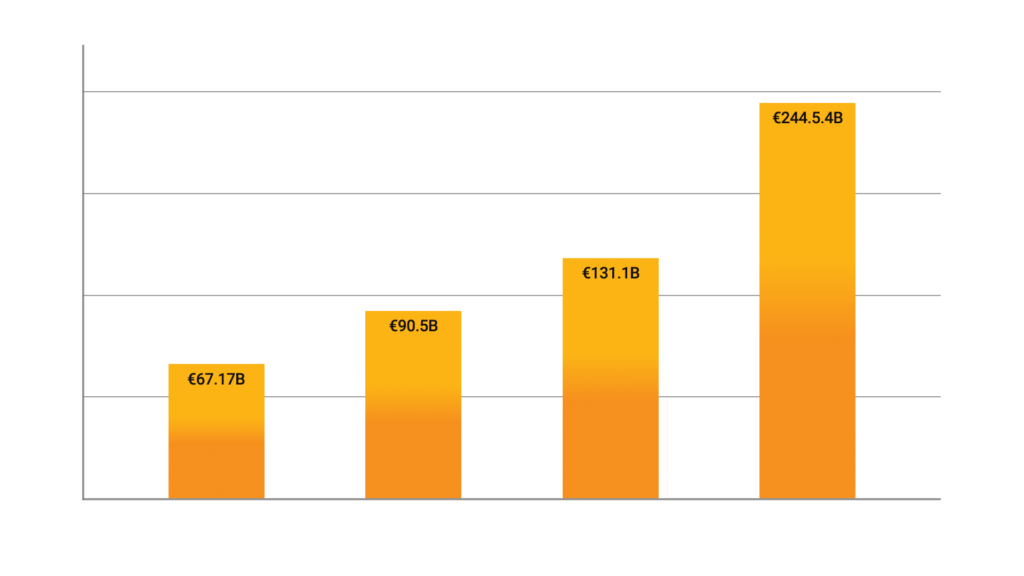

The global iGaming industry enters 2026 with the momentum of a sector reinventing itself. Online gambling rose to €90.5B in 2025, and the next decade is set for ~10.5% CAGR, driven by upgraded technologies, news audiences, emerging regulated markets, smarter payments, and player engagement experiences that elevate entertainment.

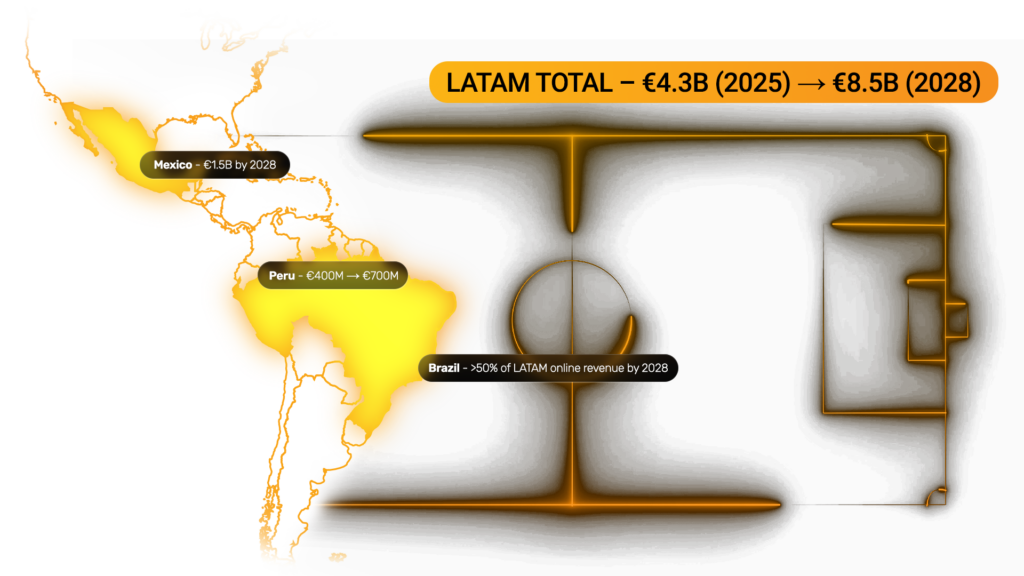

Europe remains the anchor - strict, structured, and shaping the global rulebook. Latin America acts as the rocket engine, expanding from €4.5B today to ~ €8.5B by 2028, with Brazil generating more than half of the region’s growth. North America progresses through compliance-led maturity, while Asia tells a story of contrast: the Philippines opens its doors as India eliminates monetary play entirely.

More than 450M players participated online in 2025; that number surpasses 520M by 2028. Each year, the ecosystem becomes larger, faster, and more interconnected. Mobile leads the way with 65% of bets today.

A new competitive truth defines the years ahead:

Innovation attracts. Responsible gambling secures sustainability.

And operators who balance both unlock the most sustainable advantage.

The global growth remains clear and upward:

The winners of 2026 and beyond shift from “more games” to more meaningful experiences, powered by:

As expectations rise, so does the opportunity for companies willing to innovate with accountability.

Europe acts as the strict professor of global iGaming - demanding, structured, and consistently shaping higher industry standards.

The region delivered €51B online GGR in 2025, while operators navigated:

Europe’s stance is unwavering: Show responsibility, and growth follows.

For companies who adapt with precision and transparency, the opportunity remains strong.

If Europe regulates, LATAM accelerates.

The region is projected to reach €8.5B by 2028, doubling its 2025 size. Brazil sits firmly in the center, expected to represent more than 50% of regional online revenue as federal licensing stabilizes.

Other key momentum points:

LATAM rewards operators who act quickly, localize intentionally, and build trust through payment speed and transparency.

If LATAM supplies the energy, Ontario provides the blueprint.

Ontario generated €1.2B GGR on €33.5B wagers in FY2024–25 - proof that competitive licensing and strong responsible gaming frameworks can thrive together.

In the U.S., regulation remains a patchwork, yet momentum leans toward:

Companies equipped with responsible AI, transparent onboarding, and robust AML/KYC structures achieve faster approval pathways and long-term market sustainability.

Asia in 2026 reflects two parallel realities.

Expanding markets:

• Philippines: strong KYC, a 30% e-gaming tax, and a domestically focused model

• Vietnam, Thailand, Japan: evaluating controlled legalization.

Restricting markets:

• India: complete prohibition of monetary online gaming as of October 2025.

This fragmentation demands local expertise, rapid adaptation, and early regulatory interpretation. Success comes to companies who navigate nuance rather than assume regional uniformity.

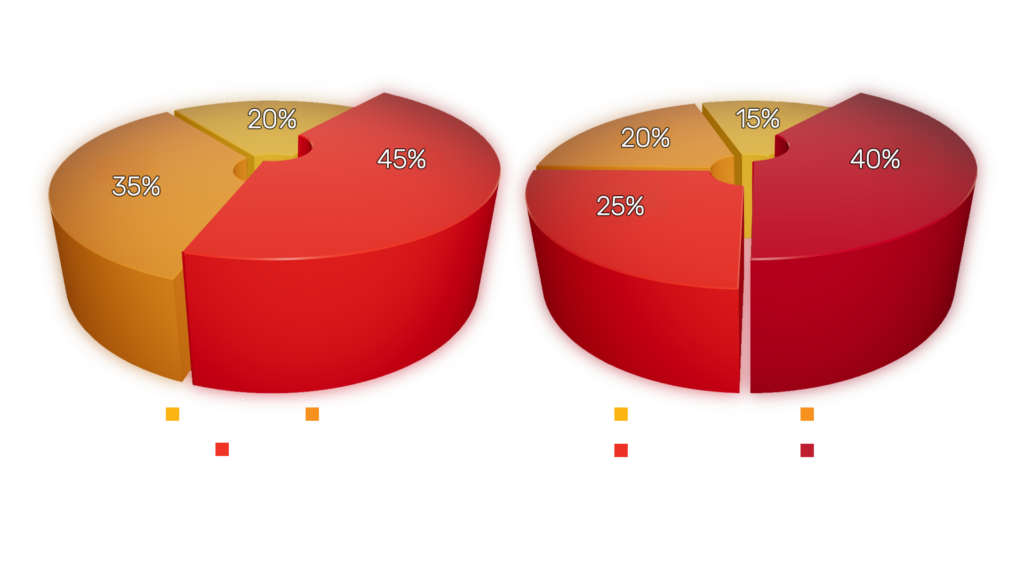

The modern iGaming experience is a connected ecosystem. Sportsbook, casino, crash games, and esports now share a unified wallet, loyalty system, and visual identity, enabling fluid movement across verticals.

Key product trends shaping 2026:

Segment mix across markets:

As players transition frequently between verticals, the ecosystem itself becomes the core product and the operator’s primary differentiator.

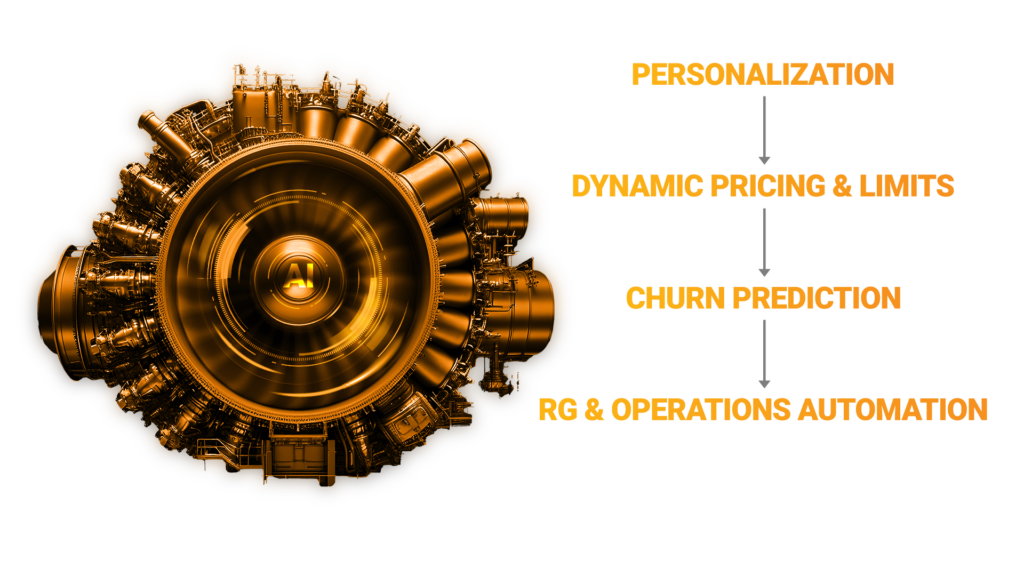

AI has become the engine behind modern iGaming. iGaming companies offer different levels of personalization in limits, payouts, payment, content, player engagement, quick bet, recommendation, suggestions and more.

Operators who embrace personalization techniques throughout the player journeys enjoy higher retention rates and CLTV.

As operators scale, data evolves from support function to strategic moat.

Heightened threats - ransomware, credential stuffing, synthetic IDs - are accelerating adoption of:

Strong data stewardship is becoming a licensing advantage and a long-term competitive differentiator.

The 2026 player is diverse, mobile-first, and increasingly demanding in expectations around speed and clarity.

Loyalty hinges on frictionless movement - fast payouts, visible fairness, and seamless access to trusted local methods.

Global regulation shifts from prescriptive rulebooks toward measurable outcomes.

Regulators increasingly evaluate:

Key developments:

Compliance evolves from obligation to performance benchmark - rewarding operators who embed safety and transparency into the core experience.

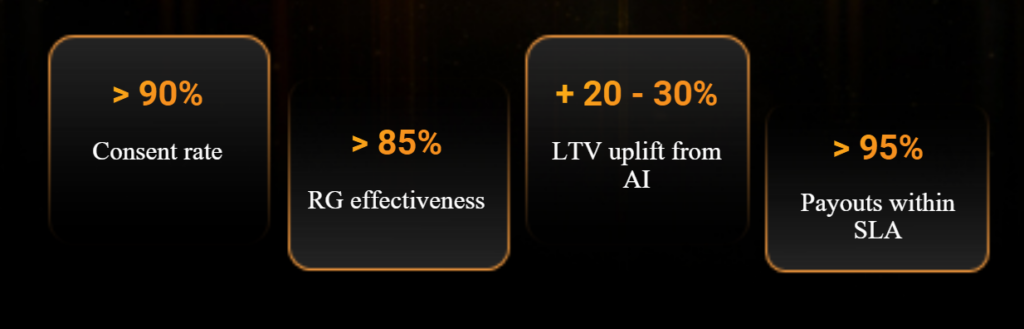

High-performing operators in 2026 will stand out through clarity, responsible play, and seamless financial flows. Their ecosystems feel safer, faster, and more intuitive - strengthened by AI-driven personalization and licensed activity that reinforces trust.

These KPIs function as revenue drivers, license enablers, and valuation multipliers - setting the benchmark for sustainable success.

In 2026, technology will keep transforming iGaming, improving player journeys, increasing conversions, propelling deposits rates, reduce KYC frictions, adopting to regulation changes, driving retention rates through personalization, player engagement and more.

Regional Potential:

Key developments:

At the heart of this progress, Delasport’s commitment to seamless, future-ready innovation keeps raising the standards for what operators can achieve.