As iGaming experts, we are aware that the Latin American iGaming industry is undergoing a dynamic transformation and opening major opportunities for operators, content providers, and B2B suppliers.

With a population nearing 670 million and a rising digital adoption curve, the region is quickly claiming its spot as one of the most promising growth frontiers in global online gambling.

After becoming one of the first suppliers to get fully certified for Brazil and sign multiple deals in this exciting jurisdiction, Delasport is uniquely equipped to provide insight into LatAm’s potential. What the current situation is in the different countries in the region and what the future holds for each of them – all of this and more is compiled in the dedicated report below.

Current Market Situation in LatAm

Latin America’s iGaming sector is gaining unprecedented traction. The total market is projected to reach US$6 billion by the end of this year, underpinned by a compound annual growth rate (CAGR) of 18.4% between 2022 and 2028, and resulting in nearly US$10 billion by the end of this timeframe.

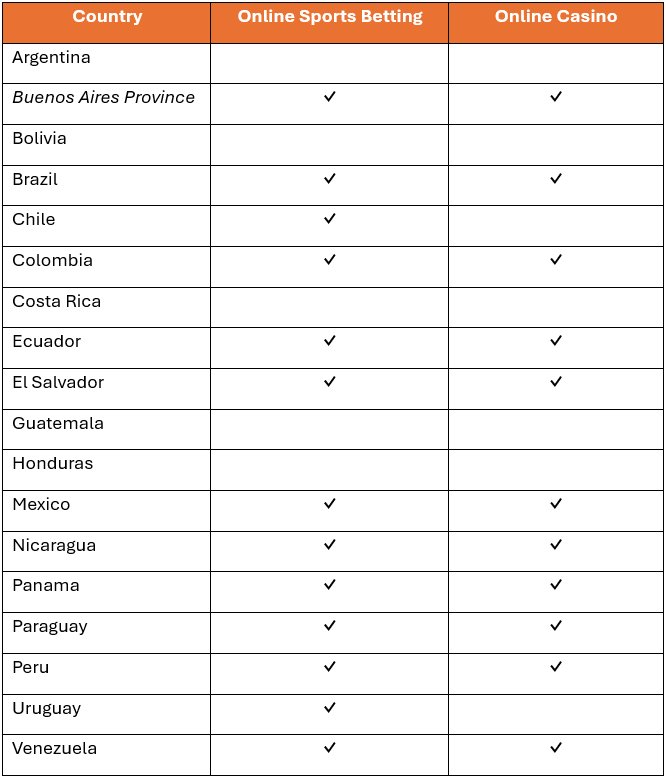

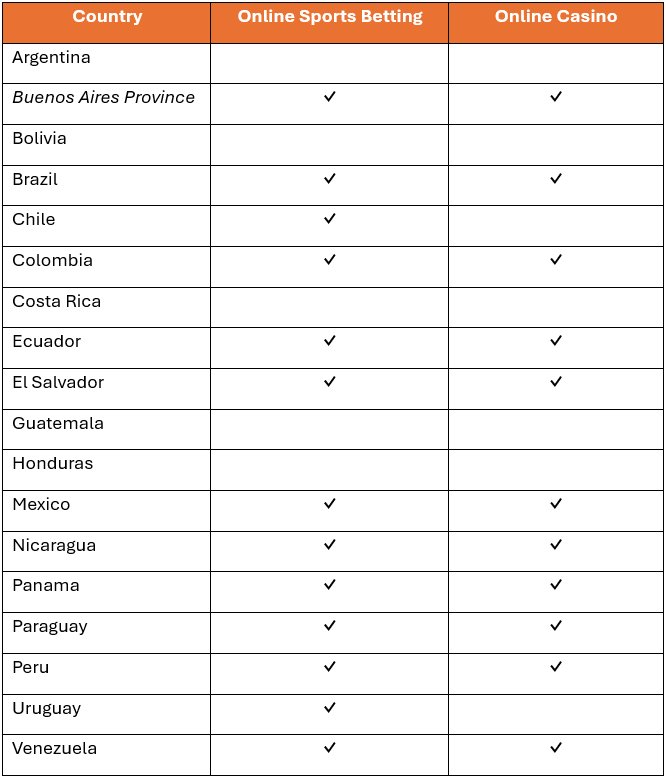

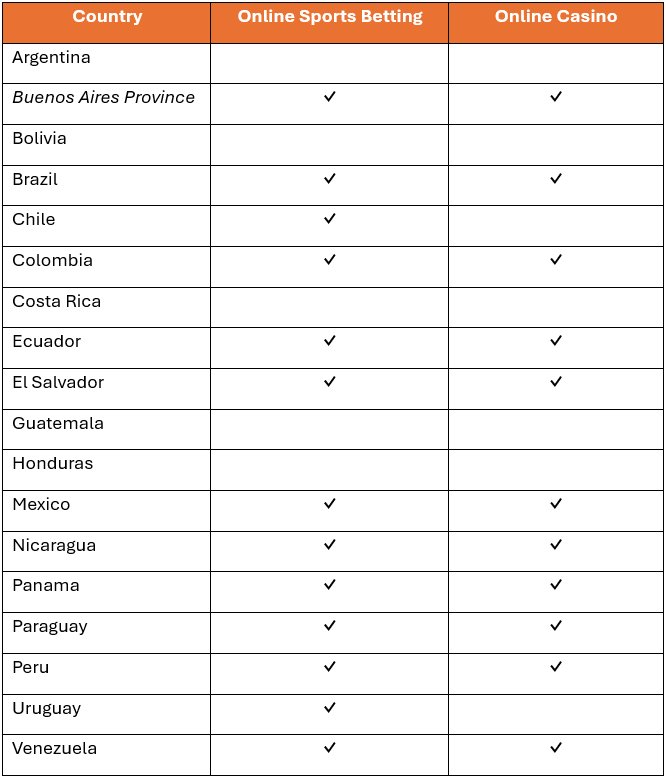

The LatAm gambling market isn’t growing uniformly - each country presents a distinct profile shaped by local regulations, consumer behavior, and economic context. As of Q1 2025, national licensing systems fully regulate online sports betting and casino games in Brazil, Colombia, Panama, and Peru. Additionally, four Brazilian states — Rio de Janeiro, Paraná, Paraíba, and Maranhão — have established their own local licensing regimes. Brazil stands out as the region’s most significant market by size and potential. According to data by H2 Gambling Capital, it is on track to become one of the largest regulated iGaming markets globally, with an annual turnover of approximately BRL 50 billion (US$10 billion) and more than 100 million real-money game participants.

Mexico also boasts impressive numbers, with annual turnover exceeding US$10 billion and a user base of around 80 million people. The country’s online segment is expected to grow by 70% over the next three years. Licensed land-based operators are permitted to offer online sports betting and casino games. These licensees can also partner with unlimited third parties to launch branded “skins” under their licenses.

Argentina’s iGaming sector is estimated at US$2.5–3.36 billion annually, supported by a relatively high 25.87% adult market penetration and a base of 8 million active players. Online gambling is regulated at the provincial level, with licenses issued in both the Province and City of Buenos Aires. Other provinces allow online gaming through state-run lotteries or existing land-based casino operators.

Colombia, the regulatory pioneer in the region, legalized online gambling in 2016 and now boasts 9.5 million unique online gambling users, with the industry contributing roughly 1.7% of national GDP.

Peru has shown robust growth with a well-defined licensing system introduced in 2024, a total player base of 5 million, and a market value close to US$2.5 billion in 2025.

Nicaragua and Paraguay allow land-based casinos to apply for online gaming licenses. However, in Paraguay, online sports betting remains under a monopoly concession model.

Meanwhile, in Venezuela, although the legal framework is less clear, national racing authorities appear to issue licenses for online betting and casino games to incumbent operators.

Elsewhere in Latin America, national lotteries play a central role in online gambling.

Regulatory Landscape

While Latin America's regulatory environment is still fragmented, there's a clear trend toward modernization and consistency. Countries are adopting more robust legal frameworks that focus on player protection, taxation, and market transparency.

Key Regional Trends

· Expansion of comprehensive licensing systems

· Government crackdowns on unlicensed operators

· Prioritization of consumer protection and responsible gaming

· A steady move toward harmonized online gambling legislation

This shift is vital for building investor confidence and fostering a more competitive and legitimate market.

Regarding sports betting, the biggest shift came from Brazil. Despite facing years of political inertia, real momentum picked up in 2023. Backed by President Lula da Silva, the country passed a landmark piece of legislation on December 30, legalizing both online and retail sports betting. This action positioned Brazil as an increasingly attractive and well-regulated destination for gambling operations.

B2B Supplier Licensing

The supplier licensing environment in Latin America is still developing and is characterized by a lack of uniformity across the region. The regulatory approach here more closely mirrors European models than those found in North America. Some jurisdictions require B2B suppliers-such as game providers, platform operators, and related service vendors-to secure a registration to work with licensed operators, while others do not.

This fragmented approach is noticeable even within individual countries. For example, established markets like Colombia, Panama, and Peru each have distinct requirements for B2B supplier oversight. In Argentina, the Province and City of Buenos Aires also maintain different standards for supplier licensing.

Attention is currently focused on Brazil, where supplier approvals were not part of the initial market rollout. However, Brazil’s official regulatory roadmap for 2025–2026 indicates forthcoming changes. Later this year, the Secretariat for Prizes and Bets (SPA) is expected to introduce new regulations governing the relationship between licensed operators and their third-party suppliers, including platform providers, game studios, and live casino vendors. One of the main goals is to prevent unauthorized content from reaching offshore markets.

Most Popular Casino Games

LatAm users show a strong preference for diverse and engaging gaming formats, driven largely by mobile use and cultural trends.

Top Categories:

1. Slots

2. Table Games

3. Fish Games

4. Crash Games

5. Bingo and Lottery-style Games

Top Sports for Betting

When it comes to sports betting, local preferences reflect both cultural affinity and media influence.

Most Popular Sports:

1. Football (Soccer)

2. Volleyball

3. Mixed Martial Arts (MMA)

4. Brazilian Jiu-Jitsu

5. Basketball

6. Motorsports

Football’s dominance is especially pronounced in Brazil and Argentina, driving much of the sportsbook revenue.

Future Outlook for LatAm’s iGaming Market

Latin America is no longer a sleeping giant - it is wide awake and accelerating toward becoming one of the world’s most vibrant iGaming regions. The combination of favorable demographics, digital infrastructure, and legal reform is creating fertile ground for growth.

To succeed, stakeholders must be ready to:

· Adapt swiftly to legal and tax changes

· Innovate technologically and locally

· Respect cultural and regional differences

· Promote responsible gambling

The next 2–4 years will be pivotal. Operators that act boldly but wisely will find themselves at the forefront of a once-in-a-generation market surge.

Choosing the right B2B partners will be key to success, and companies with proven regional expertise, like Delasport, are well-positioned to support this growth.

About the author:

Unai Concha Olabarrieta is Senior Business Director at Delasport, bringing over a decade of leadership across the global iGaming and sports betting sectors. With a Master’s in Sports Management from Universitat Pompeu Fabra, his career spans strategic roles at Yolo Group, Sporting Solutions, and Grupo Mediapro.

As iGaming experts, we are aware that the Latin American iGaming industry is undergoing a dynamic transformation and opening major opportunities for operators, content providers, and B2B suppliers.

With a population nearing 670 million and a rising digital adoption curve, the region is quickly claiming its spot as one of the most promising growth frontiers in global online gambling.

After becoming one of the first suppliers to get fully certified for Brazil and sign multiple deals in this exciting jurisdiction, Delasport is uniquely equipped to provide insight into LatAm’s potential. What the current situation is in the different countries in the region and what the future holds for each of them – all of this and more is compiled in the dedicated report below.

Current Market Situation in LatAm

Latin America’s iGaming sector is gaining unprecedented traction. The total market is projected to reach US$6 billion by the end of this year, underpinned by a compound annual growth rate (CAGR) of 18.4% between 2022 and 2028, and resulting in nearly US$10 billion by the end of this timeframe.

The LatAm gambling market isn’t growing uniformly - each country presents a distinct profile shaped by local regulations, consumer behavior, and economic context. As of Q1 2025, national licensing systems fully regulate online sports betting and casino games in Brazil, Colombia, Panama, and Peru. Additionally, four Brazilian states — Rio de Janeiro, Paraná, Paraíba, and Maranhão — have established their own local licensing regimes. Brazil stands out as the region’s most significant market by size and potential. According to data by H2 Gambling Capital, it is on track to become one of the largest regulated iGaming markets globally, with an annual turnover of approximately BRL 50 billion (US$10 billion) and more than 100 million real-money game participants.

Mexico also boasts impressive numbers, with annual turnover exceeding US$10 billion and a user base of around 80 million people. The country’s online segment is expected to grow by 70% over the next three years. Licensed land-based operators are permitted to offer online sports betting and casino games. These licensees can also partner with unlimited third parties to launch branded “skins” under their licenses.

Argentina’s iGaming sector is estimated at US$2.5–3.36 billion annually, supported by a relatively high 25.87% adult market penetration and a base of 8 million active players. Online gambling is regulated at the provincial level, with licenses issued in both the Province and City of Buenos Aires. Other provinces allow online gaming through state-run lotteries or existing land-based casino operators.

Colombia, the regulatory pioneer in the region, legalized online gambling in 2016 and now boasts 9.5 million unique online gambling users, with the industry contributing roughly 1.7% of national GDP.

Peru has shown robust growth with a well-defined licensing system introduced in 2024, a total player base of 5 million, and a market value close to US$2.5 billion in 2025.

Nicaragua and Paraguay allow land-based casinos to apply for online gaming licenses. However, in Paraguay, online sports betting remains under a monopoly concession model.

Meanwhile, in Venezuela, although the legal framework is less clear, national racing authorities appear to issue licenses for online betting and casino games to incumbent operators.

Elsewhere in Latin America, national lotteries play a central role in online gambling.

Regulatory Landscape

While Latin America's regulatory environment is still fragmented, there's a clear trend toward modernization and consistency. Countries are adopting more robust legal frameworks that focus on player protection, taxation, and market transparency.

Key Regional Trends

· Expansion of comprehensive licensing systems

· Government crackdowns on unlicensed operators

· Prioritization of consumer protection and responsible gaming

· A steady move toward harmonized online gambling legislation

This shift is vital for building investor confidence and fostering a more competitive and legitimate market.

Regarding sports betting, the biggest shift came from Brazil. Despite facing years of political inertia, real momentum picked up in 2023. Backed by President Lula da Silva, the country passed a landmark piece of legislation on December 30, legalizing both online and retail sports betting. This action positioned Brazil as an increasingly attractive and well-regulated destination for gambling operations.

B2B Supplier Licensing

The supplier licensing environment in Latin America is still developing and is characterized by a lack of uniformity across the region. The regulatory approach here more closely mirrors European models than those found in North America. Some jurisdictions require B2B suppliers-such as game providers, platform operators, and related service vendors-to secure a registration to work with licensed operators, while others do not.

This fragmented approach is noticeable even within individual countries. For example, established markets like Colombia, Panama, and Peru each have distinct requirements for B2B supplier oversight. In Argentina, the Province and City of Buenos Aires also maintain different standards for supplier licensing.

Attention is currently focused on Brazil, where supplier approvals were not part of the initial market rollout. However, Brazil’s official regulatory roadmap for 2025–2026 indicates forthcoming changes. Later this year, the Secretariat for Prizes and Bets (SPA) is expected to introduce new regulations governing the relationship between licensed operators and their third-party suppliers, including platform providers, game studios, and live casino vendors. One of the main goals is to prevent unauthorized content from reaching offshore markets.

Most Popular Casino Games

LatAm users show a strong preference for diverse and engaging gaming formats, driven largely by mobile use and cultural trends.

Top Categories:

1. Slots

2. Table Games

3. Fish Games

4. Crash Games

5. Bingo and Lottery-style Games

Top Sports for Betting

When it comes to sports betting, local preferences reflect both cultural affinity and media influence.

Most Popular Sports:

1. Football (Soccer)

2. Volleyball

3. Mixed Martial Arts (MMA)

4. Brazilian Jiu-Jitsu

5. Basketball

6. Motorsports

Football’s dominance is especially pronounced in Brazil and Argentina, driving much of the sportsbook revenue.

Future Outlook for LatAm’s iGaming Market

Latin America is no longer a sleeping giant - it is wide awake and accelerating toward becoming one of the world’s most vibrant iGaming regions. The combination of favorable demographics, digital infrastructure, and legal reform is creating fertile ground for growth.

To succeed, stakeholders must be ready to:

· Adapt swiftly to legal and tax changes

· Innovate technologically and locally

· Respect cultural and regional differences

· Promote responsible gambling

The next 2–4 years will be pivotal. Operators that act boldly but wisely will find themselves at the forefront of a once-in-a-generation market surge.

Choosing the right B2B partners will be key to success, and companies with proven regional expertise, like Delasport, are well-positioned to support this growth.

About the author:

Unai Concha Olabarrieta is Senior Business Director at Delasport, bringing over a decade of leadership across the global iGaming and sports betting sectors. With a Master’s in Sports Management from Universitat Pompeu Fabra, his career spans strategic roles at Yolo Group, Sporting Solutions, and Grupo Mediapro.