In just three years, Ontario has emerged as one of the most tightly regulated and closely watched iGaming markets in the world, setting the standard for compliance and operational excellence. As an experienced and trusted B2B supplier already active in the region, we at Delasport not only keep pace with Ontario’s evolving regulatory landscape but also guide our partners through every challenge and complexity.

Seizing the momentum of Ontario’s iGaming landscape, we’re sharing exclusive insights and official market data ahead of the Canadian Gaming Summit, offering a valuable opportunity to explore one of the industry’s most promising and tightly regulated markets. Our team will be on-site, ready to dive deeper into how operators can thrive in Ontario with the right guidance.

Contents:

- The Current Ontario iGaming Market

- iGaming Legislation in Ontario

- iGaming Advertising in Ontario

- Popular Sports in Ontario

- Popular Casino Games in Ontario

- Player Demographics and Behavior

- Looking Ahead

The Current Ontario iGaming Market

Ontario’s regulated online gambling market continues to show impressive growth in its third full year of operation. For the latest fiscal year (April 1, 2024, to March 31, 2025), the province reported gross gaming revenue (GGR) of CA$3.20 billion (US$2.32 billion), marking a 32% year-on-year increase. This is the highest annual total since the regulated market opened in April 2022 (Source).

Of this total, CA$2.40 billion (US$1.73 billion) came from online casino gaming, representing a 36% annual increase. Sports betting generated CA$724 million (US$521 million) – a 23% increase.

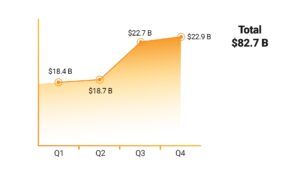

Total online wagers hit CA$82.7 billion (US$59.5 billion), up 31% from the previous year. Casino games led in wagering volume at CA$69.6 billion (US$50.1 billion), followed by betting at CA$11.4 billion (US$8.2 billion) and poker at CA$1.7 billion (US$1.22 billion).

In March 2025 alone, iGaming revenue reached CA$294.8 million (US$212.3 million), with 1.1 million active player accounts and an average revenue per account of CA$278 (US$201,90).

Ontario offers one of the most clearly structured and commercially attractive regulatory environments for B2C iGaming operators globally. Since the market’s official launch in 2022, the province has implemented a dual-agency model that balances oversight, commercial viability, and player protection.

The Alcohol and Gaming Commission of Ontario (AGCO) serves as the regulatory authority responsible for licensing and enforcing compliance with technical and operational standards under the Gaming Control Act, 1992. In parallel, iGaming Ontario (iGO) – established to conduct and manage iGaming on behalf of the province – enters into operating agreements with private-sector operators registered with the AGCO.

These private operators offer casino, sports betting, and other interactive gambling products through digital platforms under a centralized, government-managed framework. iGO retains overarching responsibility for ensuring that iGaming in Ontario aligns with provincial laws and public interest objectives, while day-to-day operations, platform management, and customer interactions are carried out by registered operators.

Ontario’s model promotes a competitive yet controlled environment, where operators must adhere to strict rules on advertising, responsible gambling, and player integrity, while still having the commercial freedom to innovate and differentiate. The system is designed to displace the unregulated market, protect consumers, and generate public benefit, ensuring that all gaming activity is accountable, transparent, and aligned with provincial standards.

For B2C iGaming operators, this framework offers a stable, scalable foundation backed by a regulatory structure that is both collaborative and forward-looking.

iGaming Advertising in Ontario

Since launching its regulated iGaming market in 2022, Ontario has quickly earned recognition for its strict, principle-based approach to online gambling advertising. The market is regulated by the Alcohol and Gaming Commission of Ontario (AGCO) and conducted by iGaming Ontario (iGO), operating within one of the most comprehensive and restrictive advertising frameworks in North America.

Affiliate and Marketing Accountability: Exclusivity with Compliance

Ontario has made it clear that operators may not engage affiliates or third-party marketers who also promote unlicensed gambling websites to Ontario players. This measure effectively shuts down gray-market overlaps and ensures marketing exclusivity within the regulated space. Commonly referred to in the industry as “affiliates,” these partners must now undergo tighter scrutiny and must comply with direct-to-consumer marketing rules outlined in their agreements.

Ban on Mass Market Bonuses and Inducements

One of the defining characteristics of Ontario’s regulatory model is its stance on bonuses and inducement of advertising. Operators are prohibited from publicly advertising promotions – including “free bets” and welcome bonuses – via mass media such as television, billboards, or paid search.

Such offers are now restricted to the operator’s own gaming site or may be shared only through direct communication (e.g., email or SMS) with players who have provided explicit opt-in consent. The language must be clear, the terms fully disclosed, and offers can only be described as “free” or “risk-free” if they truly carry no conditions, risk, or financial loss.

Several operators faced early enforcement action and fines for failing to adhere to these promotional standards, which served as a strong signal of AGCO’s resolve to uphold its rules.

Ban on Athletes and Celebrity Endorsements

In a significant move to strengthen responsible marketing, Ontario tightened its advertising standards in mid-2023 by prohibiting the use of athletes, celebrities, influencers, and even cartoon characters or symbols that are likely to appeal to minors in gambling promotions. This measure, which came into full effect in early 2024, was aimed at reducing exposure to gambling messages among youth and vulnerable audiences.

We have closely tracked this change and support its underlying goal: to promote responsible gaming through ethical communication rather than celebrity-driven influence. The ban reinforces the province’s clear stance: gambling is not entertainment to be glamorized, but an activity to be approached responsibly and transparently.

Core Marketing Standards: Truthful, Responsible, and Targeted

Ontario’s framework demands that advertising:

- Avoids targeting minors, self-excluded, or high-risk individuals;

- Excludes depictions or suggestions that gambling is a solution to financial hardship, a route to personal success, or a source of social recognition;

- Does not glamorize or mislead by implying that skill influences random outcomes or that playing longer improves one’s chances of winning;

- Includes responsible gambling messaging in every material;

- Ensures players can withdraw consent from direct advertising at any time.

An Opportunity for Integrity-Driven Growth

While Ontario’s approach may appear restrictive compared to U.S. jurisdictions, its framework reflects a distinctly Canadian commitment to player protection, market stability, and public trust. For compliance-led organizations like ours, this environment offers an opportunity to stand out as a reliable partner capable of navigating complexity.

As the regulatory landscape continues to evolve, we remain fully engaged. We’re actively tracking AGCO developments, aligning with enforcement trends, and equipping our operator partners with the clarity and tools needed to thrive in Ontario’s maturing iGaming market.

Popular Sports in Ontario

Sports betting accounted for CA$724 million (US$521 million) in revenue and CA$11.4 billion (US$8.2 billion) in total wagers in 2024-25.

As we have mentioned in one of our previous market reviews about Ontario hockey holds a special place as Canada’s national sport, making it a perennial favorite among Ontario bettors. However, given that the majority of Ontarians live within 100 miles of the U.S. border and have widespread access to American broadcast networks, U.S. sports also enjoy significant popularity in the province. Major American events—including NFL games, college football, and NCAA basketball—are regularly aired across Ontario, contributing to strong betting interest in both domestic and cross-border competitions.

In addition to hockey and football, Canadian sportsbooks see steady action on baseball, lacrosse, golf, boxing, and horse racing, reflecting the diverse sporting interests of the local betting community.

Popular Casino Games in Ontario

Casino gaming continues to dominate Ontario’s iGaming revenue, contributing CA$2.40 billion (US$1.73 billion) of the total CA$3.20 billion (US$2.32 billion) in 2024-25.

Ontario’s online casino vertical continues to thrive, driven by strong consumer demand across key product categories. Top-performing segments include:

- Online slots

- Live dealer games such as blackjack, roulette, and baccarat

- Table games, including poker variants and craps

- Instant win and virtual games

In the 2024–25 fiscal year, casino wagers reached CA$69.6 billion (US$50.1 billion) – a 34% increase year-over-year. This sharp growth underscores the sustained popularity and diversity of digital casino offerings in Ontario’s regulated iGaming market.

Player Demographics and Behavior

Key statistics:

- ~1.1 million active player accounts as of March 2025

- 72% of play occurs via mobile devices

- Player age range: 25–44 is the dominant group

- Average revenue per account: CA$278 monthly

- High engagement in multi-account usage: ~2.3 sites per player

While publicly available reports offer limited demographic detail on Ontario’s online gamblers, third-party research and industry observations indicate that the market primarily attracts younger male adults. Studies of online sports bettors typically show that 70–80% are male, with the majority aged between 19 and 45 – a trend that appears consistent in Ontario. Operators have noted that a significant portion of their user base is under 50, with the most active engagement coming from the 25–44 age group. Sports betting tends to draw a younger, predominantly male audience – largely in their 20s and 30s – while online casino gaming, though still male-dominated, appeals to a broader demographic, including older players.

Legally, all participants in Ontario’s regulated iGaming market must be at least 19 years old and physically located within the province. This is enforced through strict identity verification and geolocation measures upon registration. Within this adult user base, a strong uptake has been observed across age ranges, from college-aged individuals to middle-aged players. Mobile-first platforms have likely contributed to higher engagement among tech-savvy younger adults, while more traditional casino games attract older players familiar with land-based casinos or Ontario’s OLG.ca.

As the market continues to evolve, demographic analysis is expected to deepen. Early trends suggest high participation from the 20–40 age segment and growing interest from women—still a minority in the space but an expanding group, particularly in casual casino games. Player preferences also vary by demographic: younger males often favor sportsbooks and esports, while older users may lean toward online slots and table games.

Looking Ahead

Ontario’s iGaming market is on a clear upward trajectory, bolstered by:

- A well-regulated environment

- High consumer trust

- A diverse portfolio of 84 gaming websites operated by 49 licensed companies

With surging revenues, sustained player engagement, and a maturing regulatory framework, Ontario’s online gambling industry continues to deliver strong, profitable growth — firmly establishing the province as a global benchmark for regulated iGaming.

Backed by our proven track record of high-performing partnerships, we’re emerging as the partner of choice for operators aiming to succeed and scale in this dynamic and lucrative market. This is why anyone interested in growing their regulated operation should reach out for a meeting with us during the upcoming Canadian Gaming Summit in Toronto.